Jim DeMarco

Trusted Loan Officer & Mortgage Industry Leader

"Real estate financing is one of the most important decisions you'll make in life and the fastest way to building wealth. I'm here to help you navigate a complex process, stress free, and create a customized financing solution for your specific needs."

–Jim DeMarco–

Jim DeMarco

Trusted Loan Officer & Mortgage Industry Leader

"Real estate financing is one of the most important decisions you'll make in life and the fastest way to building wealth. I'm here to help you navigate a complex process, stress free, and create a customized financing solution for your specific needs."

–Jim DeMarco–

Meet Jim DeMarco

With over two decades in the mortgage industry, Jim DeMarco has built a career on expertise, adaptability, and a deep commitment to helping clients navigate home financing.

Starting as a mortgage loan officer at M&T Bank, Jim quickly grew through the ranks, gaining hands-on experience in retail and wholesale lending. His career took him across the country—from Buffalo, NY, to Phoenix, AZ, then to Portland, OR, and Seattle, WA—where he took on leadership roles, managed teams, and helped homeowners and mortgage brokers secure financing in evolving markets.

Jim has held leadership roles with some of the nation’s top banks, including National City, M&T Bank, and Flagstar Bank, and he now serves as a Branch Manager at CMG Home Loans —one of the leading independent mortgage banks in the country and the most innovative lender in the industry. His deep industry knowledge, combined with his ability to leverage state-of-the-art financing solutions at CMG, ensures his clients receive personalized home lending solutions tailored to their unique needs.

📞 Get in touch today to start your homeownership journey with an experienced mortgage professional by your side!

Why Choose Jim DeMarco

20 Years of Experience

With two decades in the mortgage world, Jim has seen it all. He knows how to navigate the ups, downs, and everything in between, so you don’t have to.

Tailored Financing Solutions

Every homeowner’s story is different. Jim takes the time to understand yours and builds loan options that make sense for you.

Client-First, Start to Finish

From the first chat to closing day, Jim puts your needs first. He’s known for staying involved, answering questions, and making sure you always feel supported.

Smart Programs That Speed Up Homeownership

Jim offers exclusive loan programs designed to help you build equity faster and save more in the long run. It’s not just about getting a loan; it’s about making a smart move for your future.

Who Jim Serves—and How He Makes a Difference

Real Estate Agents

Jim is a strategic partner for agents looking to close deals smoothly and keep clients happy.

He offers:

Responsive communication to keep transactions on track and avoid last-minute surprises

Customized loan solutions that align with the buyer’s unique financial profile

Deep knowledge of specialized loan products, including the all-in-one mortgage program

A collaborative mindset—Jim works as an extension of your team, not just another vendor

“When I partner with agents, my goal is to make the financing process a non-issue—so they can focus on winning offers and delighting clients.”

Buyers & Homeowners

Jim helps individuals and families navigate the often-confusing world of home financing with clarity and confidence.

He provides:

Tailored loan options that match your budget, career plans, and long-term goals

Clear, honest advice—without the industry jargon

Education-focused service, so you understand what you’re signing and why it matters

A long-term strategy, not just a short-term deal—helping you save money and build equity over time

Whether you’re buying your first home, moving up, or evaluating whether now’s the right time to buy—Jim’s here to guide you every step of the way.

Refinancing Solutions

Jim supports current homeowners looking to make smarter financial moves through refinancing.

He helps you:

Evaluate whether refinancing is the right move

Compare options to potentially lower your monthly payment, consolidate debt, or tap into home equity

Understand unique programs like the All In One Loan that can cut years off your mortgage

Make informed, strategic decisions based on your goals, not just interest rates

“Refinancing is more than a rate game—it’s about making sure the new loan actually improves your overall financial picture.”

Loan Officers & Team Growth

In addition to serving clients, Jim is actively building a high-performance team.

For new or experienced loan officers, he offers:

Hands-on mentorship and training to grow your business

Proprietary tools and access to exclusive loan products

A collaborative, mission-driven culture focused on helping people

Ongoing support from someone who’s been in the trenches and understands the real challenges of the role

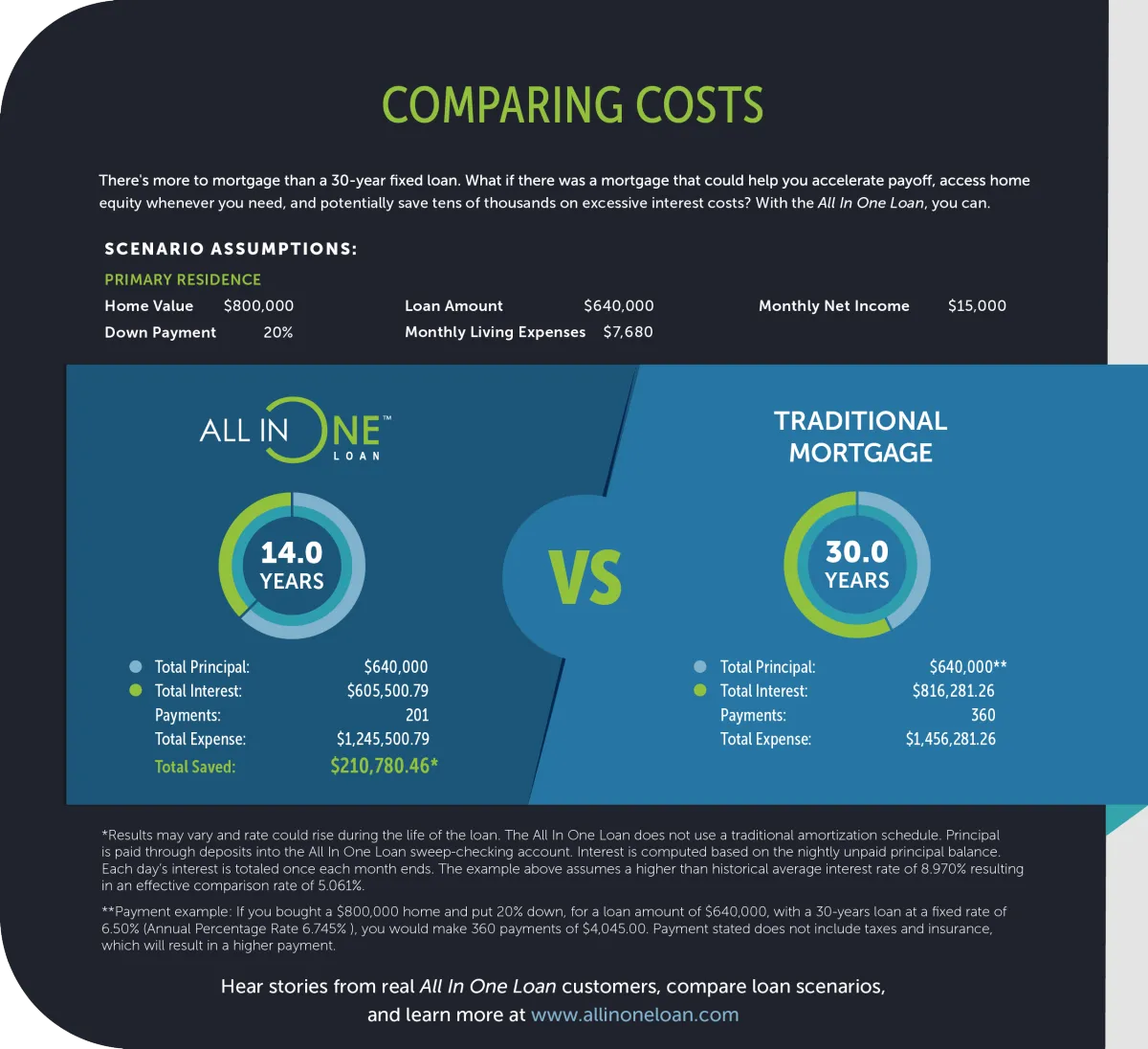

The All In One Loan – A Smarter Way to Finance Your Home

The All In One Blueprint

How the Loan Accelerates Your Wealth

✅ Merge your mortgage and daily finances—every dollar you deposit instantly reduces your loan balance, slashing interest.

✅ Pay off your home 2 to 4 times faster without changing your lifestyle.

✅ Keep full access to your funds for 30 years—no penalties, no refinancing.

✅ Save over $100,000 on average by tackling interest directly.

This isn’t just a loan. It’s a wealth-building strategy.

Pay Off Your Mortgage Faster, Save on Interest, and Stay in Control of Your Finances Traditional mortgages lock you into a fixed payment schedule, often costing you hundreds of thousands in interest over time. The All In One Loan changes the game by combining your mortgage with a fully functional banking account, allowing you to:

✅ Reduce Interest Costs – Every dollar deposited lowers your loan balance, reducing interest charges.

✅ Pay Off Your Home Sooner – Smart financial management can help you cut years off your mortgage.

✅ Access Your Home Equity Anytime – Unlike traditional loans, you’re not stuck with a fixed payment plan.

✅ Keep More of Your Money – Your income works for you, lowering your mortgage balance daily.This innovative loan structure is designed for homeowners who want financial freedom and flexibility while maximizing their savings.

What client say about All in One Loan

FOLLOW JIM

Jim DeMarco

Branch Manager

Loan Officer

NMLS ID# 1015362

This website is not authorized to take applications in the state of New York©All In One Loan™ and the All In One Loan™ logo are trademarks of CMG Home Loans, NMLS ID# 1820. All rights reserved. CMG Mortgage, Inc. dba CMG Home Loans, NMLS ID# 1820 (www.nmlsconsumeraccess.org, www.cmghomeloans.com.), Equal Housing Opportunity. AZ license #0903132. Licensed by the Department of Financial Protection and Innovation (DFPI) under the California Residential Mortgage Lending Act No. 4150025. Regulated by the Division of Real Estate (CO). Licensed Mortgage Banker-NYS department of financial services. To verify our complete list of state licenses, please visit www.cmgfi.com/corporate/licensing. 255 S King St. Suite 800, Office 09-104, Seattle, WA 98104, Branch NMLS ID# 2480234

Copyright 2026. Jim DeMarco Mortgage. All Rights Reserved.